- Paulo's Newsletter

- Posts

- How I saved £1,100 on Car Insurance with One Simple Tweak

How I saved £1,100 on Car Insurance with One Simple Tweak

It literally took me 30 seconds!

Before I get into it, I need a favour. I’m starting a Youtube and I’d really appreciate if you subscribed, I’ll be sharing a TON of value → https://bit.ly/3DpRC9S please note I

How I Saved £1,100 on Car Insurance with One Simple Tweak

TLDR: I saved over £1,100 on my car insurance quote by utilizing the job title trick! If you want to watch a video where this is quickly shown check out my TikTok: https://vm.tiktok.com/ZNdd9m1cD/

And now the main post!

I won’t lie—my car insurance has more than doubled over the last few years. I know I’m not alone in this, and when I got my most recent quote, I was almost too ashamed to share it. Owning a British car brand that gets stolen every five minutes didn’t help—it was ridiculously high!

At one point, I couldn’t even get insured for a good chunk of 2023. So, I did a deep dive into how to legally reduce my car insurance. I found several tricks, some more complicated than others, but this one is by far the easiest and could save you more than any other tweak. And best of all? It takes less than 30 seconds.

The Job Title Trick

When applying for car insurance, your job title plays a bigger role in your premium than you’d think. Insurers assess risk based on what you do for a living, and small wording differences can make a huge impact on how much you pay. It’s a bit ridiculous, but it’s the game we have to play.

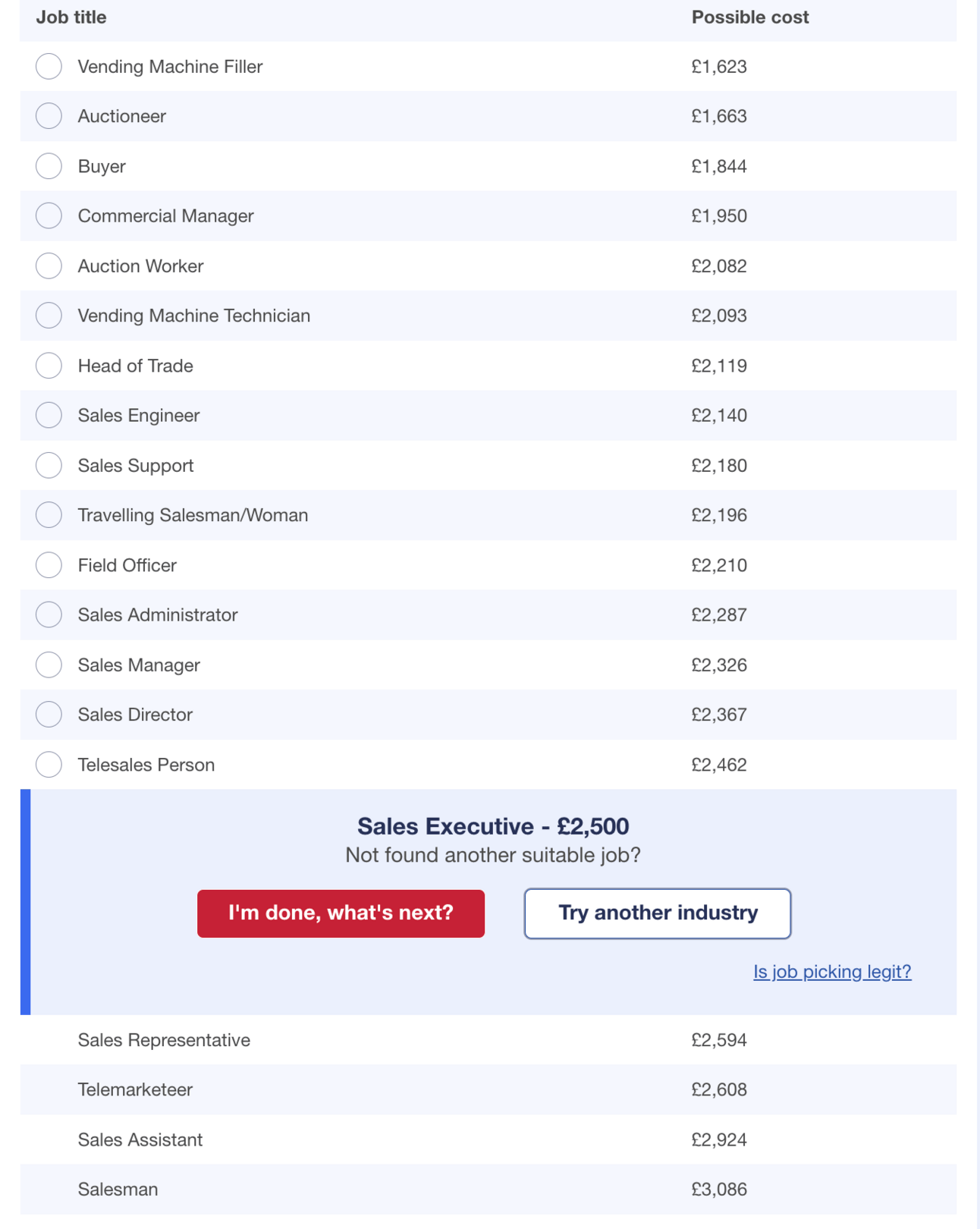

For example, I work in sales. Here’s how my insurance quotes changed based on different (but still accurate) job titles:

Salesman → £3,086

Sales Executive → £2,500

Commercial Manager → £1,950

Just by choosing ‘Commercial Manager’—a legitimate alternative—I saved £1,100 compared to ‘Salesman.’ The funny thing? I haven’t changed jobs. I haven’t taken on new responsibilities. I just tweaked how my role was described, and suddenly, I was seen as “less risky” in the eyes of insurance companies.

Why Does This Work?

Insurance companies use historical claims data to determine risk levels for different professions. If one job title has been statistically linked to more claims than another, they’ll charge higher premiums—even if the roles are practically identical.

For example:

A ‘Chef’ may pay more than a ‘Catering Manager’

A ‘Journalist’ could be charged more than a ‘Writer’

A ‘Construction Worker’ might get a higher quote than a ‘Site Coordinator’

It’s completely legal to choose the most favorable title, as long as it accurately describes your work. I’m not saying you should claim to be a ‘Doctor’ when you sell software, but if there’s a legitimate variation of your job title that saves you hundreds (or thousands), why not take advantage?

How to Try This Yourself

When getting a car insurance quote, pay close attention to the job title dropdown.

If your exact role isn’t listed, experiment with close alternatives that still accurately describe your job.

Compare the prices for each option—some minor changes can make a massive difference.

It takes less than a minute, and the savings can be huge. I also utilized the money saving expert tool which is incredibly handy for this: https://www.moneysavingexpert.com/insurance/car-insurance-job-picker/

If you try this trick and it works for you, let me know! 🚗💨

I hope that’s helpful and hopefully something you can save and apply this at your next car insurance renewal to get yourself a better price, and check out how much you could have saved if you used this tool at your last car insurance renewal!

Kind Regards

Paulo